A Closer Look at the Minimum Income Requirement for Parent and Grandparent Sponsorship

The Minimum Necessary Income (or “MNI”) requirement affects the ability of a Canadian citizen or permanent resident to sponsor certain foreign national members of the family class.

IRPR s. 120 states (emphasis added):

120. For the purposes of Part 5,

(a) permanent resident visa shall not be issued to a foreign national who makes an application as a member of the family class or to their accompanying family members unless a sponsorship undertaking in respect of the foreign national and those family members is in effect; and

(b) a foreign national who makes an application as a member of the family class and their accompanying family members shall not become permanent residents unless a sponsorship undertaking in respect of the foreign national and those family members is in effect and the sponsor who gave that undertaking still meets the requirements of section 133 and, if applicable, section 137.

Section 133(1)(j) states (emphasis added):

133. (1) A sponsorship application shall only be approved by an officer if, on the day on which the application was filed and from that day until the day a decision is made with respect to the application, there is evidence that the sponsor…

j) if the sponsor resides

(i) in a province other than a province referred to in paragraph 131(b),

(A) has a total income that is at least equal to the minimum necessary income, if the sponsorship application was filed in respect of a foreign national other than a foreign national referred to in clause (B), or

(B) has a total income that is at least equal to the minimum necessary income, plus 30%, for each of the three consecutive taxation years immediately preceding the date of filing of the sponsorship application, if the sponsorship application was filed in respect of a foreign national who is

(I) the sponsor’s mother or father, (my note: i.e. parent)

(II) the mother or father of the sponsor’s mother or father, (my note: i.e. grandparent) or

(III) an accompanying family member of the foreign national described in subclause (I) or (II), and

(ii) in a province referred to in paragraph 131(b), is able, within the meaning of the laws of that province and as determined by the competent authority of that province, to fulfil the undertaking referred to in that paragraph;

“Minimum necessary income” is defined in IRPR sections 2 and 134 and identified as “… the minimum amount of before-tax annual income necessary to support a group of persons ….”

minimum necessary income means the amount identified, in the most recent edition of the publication concerning low income cut-offs that is published annually by Statistics Canada under the Statistics Act, for urban areas of residence of 500,000 persons or more as the minimum amount of before-tax annual income necessary to support a group of persons equal in number to the total number of the following persons:

(b) the sponsored foreign national, and their family members, whether they are accompanying the foreign national or not, and

(c) every other person, and their family members,

(i) in respect of whom the sponsor has given or co-signed an undertaking that is still in effect, and

(ii) in respect of whom the sponsor’s spouse or common-law partner has given or co-signed an undertaking that is still in effect, if the sponsor’s spouse or common-law partner has co-signed with the sponsor the undertaking in respect of the foreign national referred to in paragraph (b). (revenu vital minimum)

By the above definition, it is important to properly calculate the size of your family and as well take into account any changes that might occur if your family size were to change during the application process.

It is also important to note R.134(1) on how income is calculated, especially the exclusions and how that may affect the income amounts (emphasis added)::

Income calculation rules

134 (1) Subject to subsection (3), for the purpose of clause 133(1)(j)(i)(A), the sponsor’s total income shall be calculated in accordance with the following rules:

(a) the sponsor’s income shall be calculated on the basis of the last notice of assessment, or an equivalent document, issued by the Minister of National Revenue in respect of the most recent taxation year preceding the date of filing of the sponsorship application;

(b) if the sponsor produces a document referred to in paragraph (a), the sponsor’s income is the income earned as reported in that document less the amounts referred to in subparagraphs (c)(i) to (v);

(c) if the sponsor does not produce a document referred to in paragraph (a), or if the sponsor’s income as calculated under paragraph (b) is less than their minimum necessary income, the sponsor’s Canadian income for the 12-month period preceding the date of filing of the sponsorship application is the income earned by the sponsor not including

(i) any provincial allowance received by the sponsor for a program of instruction or training,

(ii) any social assistance received by the sponsor from a province,

(iii) any financial assistance received by the sponsor from the Government of Canada under a resettlement assistance program,

(iv) any amounts paid to the sponsor under the Employment Insurance Act, other than special benefits,

(v) any monthly guaranteed income supplement paid to the sponsor under the Old Age Security Act, and

(vi) any Canada child benefit paid to the sponsor under the Income Tax Act; and

(d) if there is a co-signer, the income of the co-signer, as calculated in accordance with paragraphs (a) to (c), with any modifications that the circumstances require, shall be included in the calculation of the sponsor’s income.

Exception

(1.1) Subject to subsection (3), for the purpose of clause 133(1)(j)(i)(B), the sponsor’s total income shall be calculated in accordance with the following rules:

(a) the sponsor’s income shall be calculated on the basis of the income earned as reported in the notices of assessment, or an equivalent document, issued by the Minister of National Revenue in respect of each of the three consecutive taxation years immediately preceding the date of filing of the sponsorship application;

(b) the sponsor’s income is the income earned as reported in the documents referred to in paragraph (a), not including

(i) any provincial allowance received by the sponsor for a program of instruction or training,

(ii) any social assistance received by the sponsor from a province,

(iii) any financial assistance received by the sponsor from the Government of Canada under a resettlement assistance program,

(iv) any amounts paid to the sponsor under the Employment Insurance Act, other than special benefits,

(v) any monthly guaranteed income supplement paid to the sponsor under the Old Age Security Act, and

(vi) any Canada child benefit paid to the sponsor under the Income Tax Act; and

(c) if there is a co-signer, the income of the co-signer, as calculated in accordance with paragraphs (a) and (b), with any modifications that the circumstances require, shall be included in the calculation of the sponsor’s income.

Finally, a clause that frequently captures individuals, especially in those applications that take increased time to process is IRCC’s ability under R. 134(2) [subject to R.134(3) calculation rules] to ask for updated evidence of income if more than 12 months have elapsed since the receipt of the sponsorship application or an officer receives information that the sponsor is no longer able to fulfil the obligations of the sponsorship undertaking (emphasis added):

Updated evidence of income

(2) An officer may request from the sponsor, after the receipt of the sponsorship application but before a decision is made on an application for permanent residence, updated evidence of income if

Modified income calculation rules

(3) When an officer receives the updated evidence of income requested under subsection (2), the sponsor’s total income shall be calculated in accordance with subsection (1) or (1.1), as applicable, except that

(a) in the case of paragraph (1)(a), the sponsor’s income shall be calculated on the basis of the last notice of assessment, or an equivalent document, issued by the Minister of National Revenue in respect of the most recent taxation year preceding the day on which the officer receives the updated evidence;

(b) in the case of paragraph (1)(c), the sponsor’s income is the sponsor’s Canadian income earned during the 12-month period preceding the day on which the officer receives the updated evidence; and

(c) in the case of paragraph (1.1)(a), the sponsor’s income shall be calculated on the basis of the income earned as reported in the notices of assessment, or an equivalent document, issued by the Minister of National Revenue in respect of each of the three consecutive taxation years immediately preceding the day on which the officer receives the updated evidence.

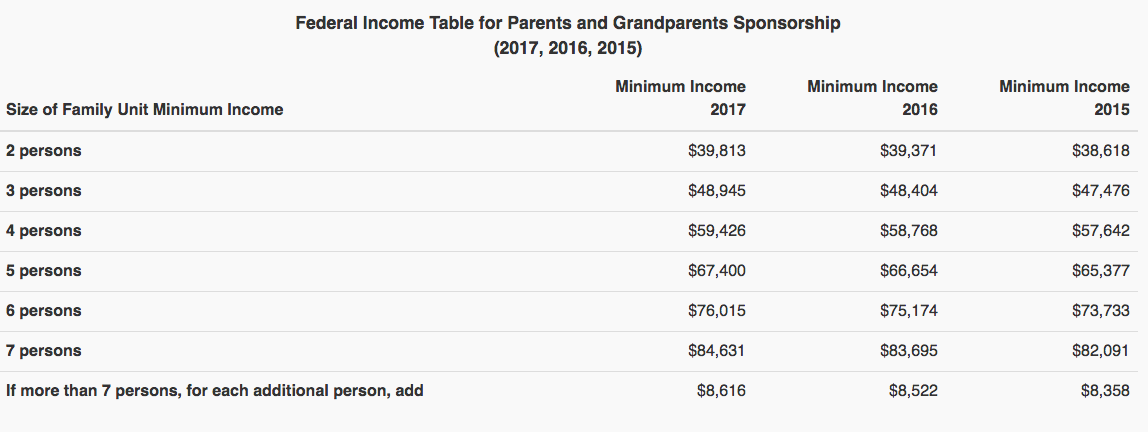

What is the $$ Required for the Minimum Income Requirement (as of the date of this post)?

IRCC sets out the MNIs for parent and grandparent sponsorship, which discussed above, are the Minimum Necessary Income (“MNI”) plus 30%. IRCC obtains that information by either by an Applicant’s consent on Question 8 of the Financial Evaluation for Parents and Grandparents Sponsorship form or by completing the Income Sources for the Sponsorship of Parents and Grandparents form and submitting NOAs for the three preceding years.

Expect this […]

Christmas from behind a Cup of *Starbucks* Coffee

The gruff beard counterpoints the cheerful Santa Hat.

Perhaps a cover to the balding hair – alas another year gone – it certainly has been a long one.

Two men – brothers, lovers – who knows and frankly it’s not my place to judge.

Human love is human love – and I can see in their tenderness with each other that it is love by very definition of the word.

A pink haired goddess. Rapunzel of today’s generation. She leaves but acknowledges her presence or maybe I have acknowledged hers.

A stunning beauty.

I said I would stay local but I find myself again in Starbucks. Work is the agenda but people watching is the reality show.

“I’ll pick you up tonight” kissed to the head and check from one man to another. He leaves. He stays. Sniffles either from a persistent cold but more likely from an insistent love.

I can imagine he’s texting him as he leaves the door. I remember all too well those days as well. Phone a lifeline and whatever the maker decided to do with battery life, the heart beat.

Christmas does different things to different people. Those with stories of loss are all to conscious of what they have lost. For others, the ability to take a much needed deep breath. To spend a little of the hard-earned money on loved ones. To reconnect with those we have spent too little time with.

Friends from fargone places send messages wishing you happy holidays. The warm moments that remind you that the stocking isn’t always full of coal.

In all this global uncertainty, caravans and controversy – the universal truth that we are all human spirits and souls on the same sleigh ride of life is an important one. Taking time aside to love one another, interact with one another, smile at one another – a raison d’etre for living.

Wishing you and your loved ones endless love and happiness over a cup of Starbucks coffee (no sugar – my weight is becoming problem).

(p.s. the guy with the Santa hat actually works here!).

(p.p.s I will be putting up more blogs in 2019 – it is my resolution every year but this year I’m committed).