Introduction

Thanks to the new changes to the Citizenship Act, all of which are now officially in-force as of June 11, 2015, there are also new Citizenship Forms and Regulations.

Part of the changes to the Forms and Regulations are new requirements for Applicants to provide their Social Insurance Number. Unlike in the context of permanent residents, where Citizenship and Immigration Canada (CIC) has made providing Social Insurance Numbers an option, for Citizenship failure to provide a social insurance number if you have one and tax filings if you are required to file them will lead to your application being returned pursuant to s.13 of the Citizenship Act.

While reviewing the CIT0002E form, I noticed something that is worth knowing about providing your SIN number. I will explain this point in a series of screenshots (apologies in advance if they are slightly blurry). You can follow along with the form here.

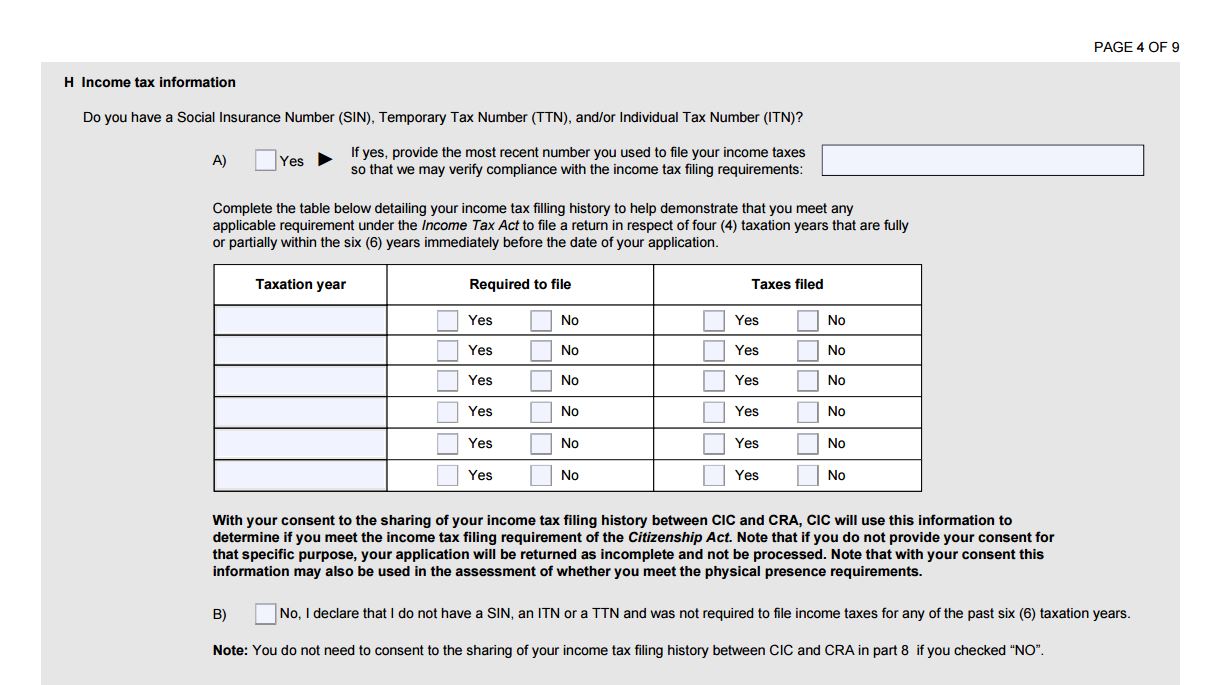

Section H: Income Tax Information

In this section you are either asked to provide a SIN, a TTN, or an ITN. Canada Revenue Agency (CRA) has clarified what each of these are in here. In short, if you are not eligible for a Social Insurance Number and have submitted a T1261 you are given an Individual Tax Number. If you have immigrated to Canada or become a tax resident and are eligible to apply for a Social Insurance Number but has not yet received it, CRA will issue you a temporary Tax Number

The selection box is kind of confusing as you can see above. It appears the only thing that would trigger selecting no (which also exempts you from having to provide a part 9 consent to allow Canada Revenue Agency disclosure) is if you are not required to file taxes [ps form creators there’s a typo it says part 8].

Importantly, the form reminds you that with your consent CIC will use that information to determine if you meet the income tax filing requirement of the Citizenship Act. If you do not consent, it states that your application will be returned as incomplete and not processed. It also states that the information may be used to determine whether you meet the physical presence requirements. As a reminder those requirements are 4 years out of 6 years and 183 days or more in four calendar years out of the six calendar years being relied upon.

Again, with social insurance numbers and at the ability to trace your financial steps that is easily verifiable.

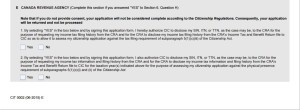

Part 9 (E) CANADA REVENUE AGENCY

The section begins with another reminder that if you do not consent your application is not complete according to the Citizenship Regulations. Arguably, there’s no real consent being asked for and again the regulations make it clear it is a requirement.

What is very interesting about this section and that it is important to be aware of is that the sections being cited as the impetus for the disclosure are not the only purposes for which the information can be used.

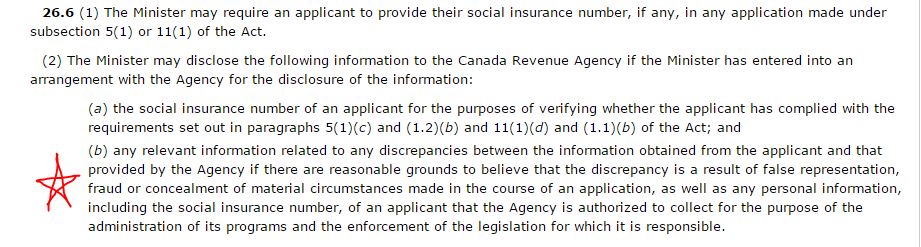

Subsection 5(1)(c) is the grant provision. However, as the wording of the Regulation states there are other purposes that the information will be used for:

Section 26.6(2) of the Citizenship Regulations clearly suggests that the information can also be used to determine discrepancies of material circumstances made in the curse of an application. Not necessarily just the Citizenship Application and arguably also within the realm of other government programs.

What Does This All Mean?

Misrepresentation. You can kind of tell it is the theme of the posts today. With the new regulations, it is very possible that misrepresentations on any previously submitted application related to tax or immigration could trigger misrepresentation under s.40 and perhaps even the offense of misrepresentation under s.127.

Prior to submitting a Citizenship Application it is crucial that a full Access to Information and Privacy request to Citizenship and Immigration Canada, Canada Border Services Agency, and the Canada Revenue Agency is performed to ensure the consistency of past submissions and correct any inconsistencies before applying for Citizenship.